TMLS2020: Difference between revisions

| Line 169: | Line 169: | ||

Currently, this application is within the Bank’s international banking (IB) footprint, however, solutions are reuseable and scalable for application within the Canadian marketplace. | Currently, this application is within the Bank’s international banking (IB) footprint, however, solutions are reuseable and scalable for application within the Canadian marketplace. | ||

=== Algorithmic Decision Making: Exploring Practical Approaches to Liability, Fairness, and Explainability === | |||

10am | |||

who: | |||

* Patrick Hall (Speaker) Principal Scientist, bnh.ai | |||

* Talieh Tabatabaei (Speaker) Data Scientist, TD Bank | |||

* Richard Zuroff (Speaker) Advisor, Element AI | |||

== Link dump == | == Link dump == | ||

Revision as of 15:39, 18 November 2020

Notes from chat channels

What are people working on?

Nov 16th

Workshops

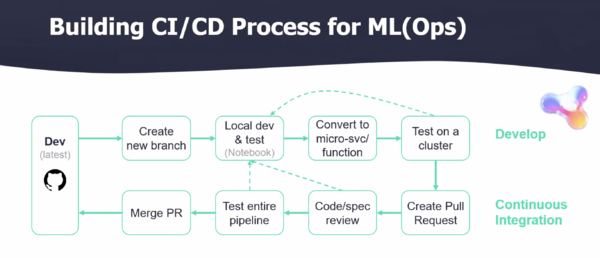

Topic: Workshop: MLOps & Automation Workshop: Bringing ML to Production in a Few Easy Steps

Time: Nov 16, 2020 09:00 AM Eastern Time (US and Canada)

who: Yaron Haviv https://medium.com/@yaronhaviv

Tools:

- mlrun - lots of end to end demos /demos

- nuclio

- kubeflow

What it gives us:

- CICD for ML

- auditability

- drift

- feature store for meta data, and drift.

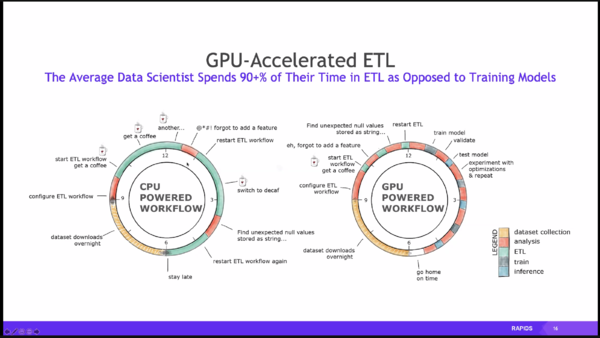

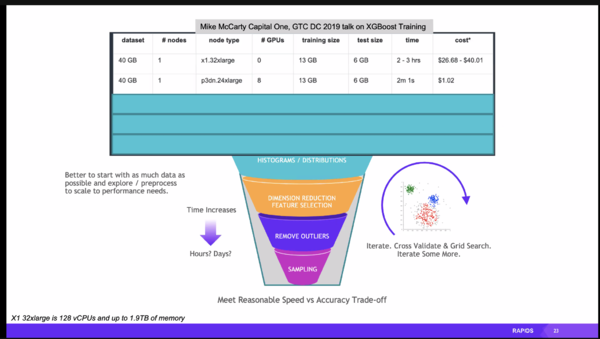

Topic: Reaching Lightspeed Data Science: ETL, ML, and Graph with NVIDIA RAPIDS

Time: Nov 16, 2020 11:00 AM Eastern Time (US and Canada)

https://github.com/dask/dask-tutorial

who: Bradley Rees ( from Nvidia )

https://medium.com/rapids-ai/gpu-dashboards-in-jupyter-lab-757b17aae1d5

https://nvidia.github.io/spark-rapids/

file formats:

h5 - for gentic info.

h5ad - compressed annotated version

nica lung

genetic analysis, 2d visualization

UMAP

- https://www.nature.com/articles/s41467-020-15351-4

- https://umap-learn.readthedocs.io/en/latest/basic_usage.html

Managing Data Science in the Enterprise

who:

- Randi J Ludwig , Sr. Manager Applied Data scientist - Dell Technologies

- Joshua Podulska - Chief Data scientist - Domino Data lab.

The age old “discipline” problem. This is not a data science problem and this is not a technology problem, this is a human problem.

"Paved paths"

kathy oneil weapons of math descruction

Nov 17th

Bonus Workshop: How to Automate Machine Learning With GitHub Actions

11:00 am

boring: what is docker? Skipped it.

Black-Box and Glass-Box Explanation in Machine Learning

who: Dave Scharbach who: rich cauruna

gradient boost decision tree

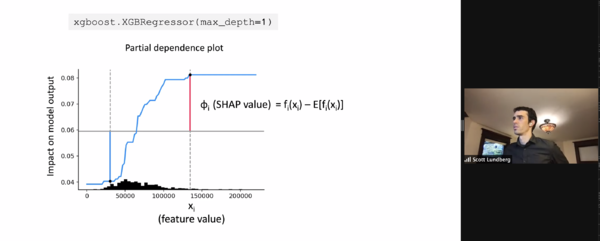

SHAP vales Shapley - the difference between the averge effect and the effect for the value.

linear model.

use "partial dependent plot " to see the effect of one input.

tree explainer for say GBM model.

two matrix: out matrix, and explainer matrix

output matrix has the same metrics, and explainer matrix has multple metrics.

bswarm plot

when you look at global summary stats, you wash away Rare high magnitude effect.

vertical dispersion.

interaction effect, agent and gender, there ar esome sublte bits,

we often see "treatment effects" if you BUN is higher than X then you get treatment Y, ergo the graph of BUN level has "notches" in it where treatments are triggered, drug .. dialysis, etc.

EBM - explainable booster machine - some in R and spark on the way.

Project: microsofts "interpret" package. EBM

https://github.com/interpretml/interpret

"How do you explain a model?"

also see SHAP package. https://github.com/slundberg/shap

shap.plots.waterfall() neato!

Nov 18th

Customer Segmentation, Pricing, and Profit Optimization for International Banking

who:

- Shirin Akbarinasaji (Speaker) Senior Data Scientist, Scotiabank

- Navid Kaihanirad (Speaker) Senior Data Scientist, Scotiabank

- Cheng Chen (Speaker) Data Scientist, Scotiabank

WTP Willingess to pay

price response function

9:25 am - 10:10 am

- Abstract

Background: Pricing is a famous business issue in many companies and organizations. The approach behind pricing analytics can be formulated as customer segmentation and constrained optimization problems in order to increase sales and/or revenue.

Aim: The main objective is to design a pricing product that can help to :

1) Identify groups of elastic and inelastic customers,

2) Determine the optimal rate for each group of customers,

3) Agnostic pipeline that can be reusable for other pricing use cases.

Methodology: Scotiabank proposes to use model-based recursive partitioning (MOB) which uses product characteristics and customer attributes as input and customer willingness to pay as output to segment customers. For each customer segmentation, the company found the demand curve function and formulate the nonlinear optimization problem that maximizes the sale or revenue using PYOMO and IPOPT.

Results: This pricing product has been used in three different countries: Peru, Columbia, and Mexico in various products such as mortgage, SPL, and term deposit with great feedback that has helped Scotiabank to capture international banking customer behavior and their price sensitivity more promptly.

Currently, this application is within the Bank’s international banking (IB) footprint, however, solutions are reuseable and scalable for application within the Canadian marketplace.

Algorithmic Decision Making: Exploring Practical Approaches to Liability, Fairness, and Explainability

10am

who:

- Patrick Hall (Speaker) Principal Scientist, bnh.ai

- Talieh Tabatabaei (Speaker) Data Scientist, TD Bank

- Richard Zuroff (Speaker) Advisor, Element AI